Three Way News

Your Source. For everything. Really.

Contributors

- Hammer

- Jambo

- Libby Mae

Current Poll

Recurring features

Hammer's Favorites

- Dobson v. Sponge-Bob

- Calvin, the nest egg

- Pat's predictions

- Bachmann spins Cupertino

- 205 atheists assume the bench

- Fox spins Oil for Food

- Fact check: highest taxed state

- Gen. Myers v. Reality

- Janice Rogers Brown

- Killing Field

- Kline hates Big Bird

- Vote Luca Brasi!

- Cornyn's Stalinist Supreme Court

- Rumsfeld's hidden metrics

Jambo's Favories

- Dolphin research updates

- We all shine on

- If you have to write...

- Columnist NY Times should have

- Truth about taxes

- Fourth of July

- Movie objects

- Lost in supermarket

- Dysfunctional Farmer Labor party

- Punks you hated

- Some preacher from east

- Winning issues

Thursday, April 06, 2006

The rich get richer, the poor get the picture.

In the post below Hammer makes reference to some tax figures that were published in a NYT article yesterday that show the effects of W's investment income tax cuts. No real surprise, the overwhelming benefit goes to the very wealthy in society. Anyone who follows tax policy knows, or at least suspected, the results and the arguments involved. I was surprised, tho, to see that they actually found some prick named Stephen J. Entin who would publicly state that the proper level of taxation on investment income should be zero. That's right, if conservatives had their way people who got a paycheck for mopping floors or working in nursing homes would pay ALL the taxes while people who inherit a fortune and live off interest would pay nothing. Zero. Now someone will likely comment that not taxing investment income will increase investment and spur economic activity. But that absolutely is not the case when the government is running a deficit. In that case even if every dollar of foregone tax revenue is available for investment it will have no effect on economic growth because the government turns around and borrows that same amount to finance the debt. You pump an extra $100 bucks into the system and the government has to borrow an extra $100 and takes is right back out. And of course if only $75 of that extra $100 gets invested the government ends up taking away $25 that would have been invested in the private sector and you're worse off than when you started.

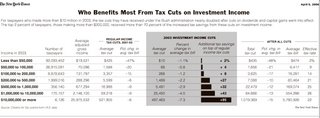

But that's not what I really wanted to post about. What I found interesting was the chart that went along with the article:

While this shows just how much benefit the ultra rich got from the investment tax cut what caught my eye was the column at the far right (as it were) that shows effective tax rates and makes it look like working class Americans are taxed at way lower rates than the wealthy. This has long been a pet peeve of mine since for 85% of Americans the INCOME tax is not their greatest tax burden, social security taxes are. When most Americans look at their pay stub and see how much of their check has been taken by the government they don't make the distinction yet the Republicans try to pretend that they are doing a big favor to the middle and working classes by cutting income taxes when what they are mostly doing is helping their rich supporters.

The chart makes it look like the average wage earner making less than $50,000 is only paying a tax rate of 2%. But they are also paying 6.2% in SSI taxes for a real rate of 8.2%. But that is not the case for people with higher incomes because you only pay SSI on wages up to $87,000 a year, a maximum of about $5400. If you have wages that equal $87k a year you pay $5400 in SSI taxes. If you make a $1,000,000 in wages you also pay $5400 a year, a rate of only 0.5%. [Another way to look at it: If you and your spouse both work and have combined income over $87,000 you pay more SSI tax than Bill Gates or Warren Buffet. Not a higher percentage, you pay more total dollars!] And if you make $1,000,000 a year in dividend, interest or capital gains you pay $0 of SSI tax every year. Taking that into account here are the actual effective rates:

(There is also the 1.45% Medicare tax which is paid on all wages. I have not added that into the mix because I don't know the breakdown of wages vs. investment in the middle categories. But it is a safe bet to say that almost all income for people making under $100,000/year is wages and therefore subject to the tax whereas very little of the income for people in the $10 million + range is wages. So the bottom bracket is paying 9.65%, the $50-100k bracket is paying about 16.6% and the top is paying 22.3%.)

Is that still a progressive tax system? Well, yes. But not very.

Bottom line: if you are typical American wage earner, economically at least, the Republican party is NOT on your side, no matter what they tell you about lower taxes.

4 Comments:

Don't blame me -- I voted for Steve Forbes.

Oh, and

[the chart] makes it look like working class Americans are taxed at way lower rates than the wealthy.

as indeed they are. I agree it should be even lower -- zero, for many more folks, but don't be saying it's not substantially lower already and expect to be taken seriously (said the guy who claimed to have voted for Steve Forbes... that was a joke, by the way).

And

if conservatives had their way... people who inherit a fortune and live off interest would pay nothing.

Well, if that one guy they quote had his way. Anybody here heard of him before? He ain't exactly Ronald Reagan or Jack Kemp or Alan Greenspan or Milton Friedman or Ludwig von Mises or Henry Hazlitt or Friedrich Hayek or Frederic Bastiat.

By Joey de Vivre, at 11:39 PM

That "one guy" served in the Reagan administration and has a graduate degree from University of Chicago (which isn't actually all that funny a school after all). Click here to see him posing with both Steve Forbes and Jack Kemp.

Yes, I admit it is a slightly progressive tax system but my point is that the difference between the rates at the top and the bottom is not nearly as great as conservatives make it out to be and they have no real interest in helping out the folks at the bottom or they would do something like exempt the first $20,000 of wages from SSI tax while getting rid of the upper limit. Gosh, that would make

SSI taxes the oft wished for flat tax! Woo hoo, saving social security and putting thru a flat tax at the same time! Why do you suppose the Republicans don't do that?

Ho ho. Vonnegut went to grad school there, which is about as funny as you can get. Then again, so did Paul Wolfowitz, which isn't all that funny.

exempt the first $20,000 of wages from SSI tax while getting rid of the upper limit.

I'd vote for that, but my registration card says "Democrat." It's not like our party hasn't had a hundred chances to do that same thing -- why do you suppose we didn't? Same trough, perhaps?

By Joey de Vivre, at 7:34 AM

Jambo:

Just to be clear, you're only talking about federal taxes paid. At the state level, of course, you'd have to mix in the blend of income taxes, sales taxes, and property taxes that people pay. In many states, this blend of taxes tends to increase the tax burden on the poor.